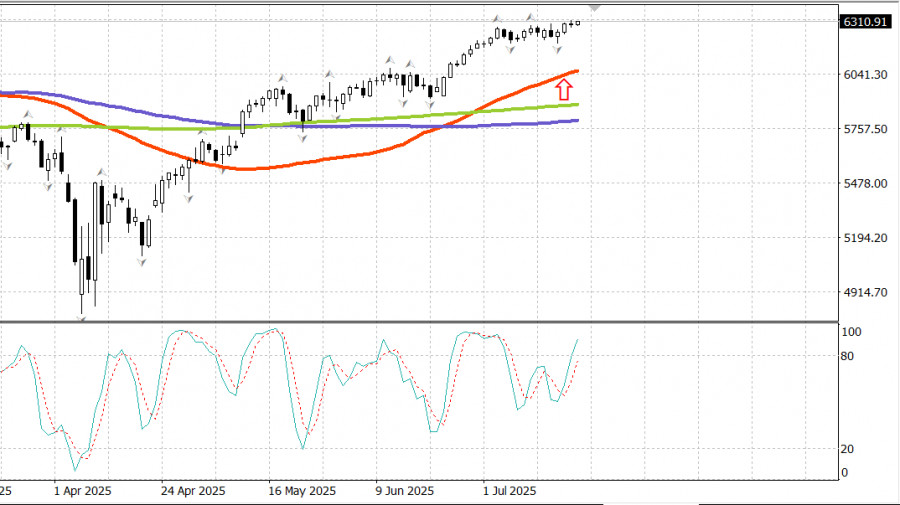

S&P 500

Overview for July 21

The US market ended the week with gains

Major US indices on Friday: Dow -0.3%, NASDAQ +0%, S&P 500 +0%, S&P 500 at 6,297, trading range 5,900–6,400.

The stock market opened on a positive note following several key earnings reports released before the bell, but broad selling pressure quickly capped gains, keeping major indices in a tight range and ultimately closing them flat from the opening levels.

Futures posted modest gains after another wave of generally upbeat earnings reports, then climbed further following the release of June housing starts and building permits data. Headline numbers surprised to the upside, with starts at 1.321 million (consensus: 1.300 million) and permits at 1.397 million (consensus: 1.383 million).

However, report details revealed weakness in single-family housing starts and building permits, which blunted the initial momentum and couldn't prevent the market from slipping into a sell-off shortly after the S&P 500 (0%) and Nasdaq Composite (+0.1%) notched fresh all-time highs.

Selling during the session was broad but moderate, consistent with a "sell-the-news" pattern hitting companies that beat expectations. Netflix (NFLX 1209.24, -64.93, -5.1%), American Express (AXP 307.95, -7.40, -2.4%), and 3M (MMM 153.23, -5.81, -3.7%) all came under pressure despite posting overall positive earnings and guidance.

Some companies, however, delivered strong post-earnings performances. Charles Schwab (SCHW 95.78, +2.68, +2.9%) hit a new 52-week high, while Comerica (CMA 65.32, +2.90, +4.7%) and Regions Financial (RF 26.01, +1.50, +6.1%) also posted solid gains.

Five sectors finished the day in the green, though only consumer discretionary (+1.0%) and low-weighted utilities (+1.7%) rose more than half a percent. Energy (-1.0%) and healthcare (-0.6%) were the only sectors to decline more than half a percent.

Lack of buying conviction was evident across the equity space. The market-cap weighted S&P 500, the equal-weighted S&P 500, and the Vanguard Mega Cap Growth ETF all ended the day unchanged. The S&P MidCap 400 (-0.1%) slightly lagged, and while the Russell 2000 (-0.6%) posted the weakest daily performance, it still managed to gain 3.0% for the week.

Treasuries finished the week on a stronger note as relative strength in short-dated bonds drove 2-year and 5-year yields to their lowest levels of the week, while longer-term bonds continued to underperform.

Fed Governor Christopher Waller reiterated on Thursday evening that a rate cut should come at the July FOMC meeting. However, the fed funds futures market remains deeply skeptical of such a move, with the CME FedWatch tool pricing in just a 4.7% implied probability of a cut on July 30.

The 2-year yield ended the session down four basis points at 3.88%, while the 10-year yield slipped three basis points to 4.43%.

Year-to-date performance:

Nasdaq Composite: +8.2%S&P 500: +7.1%DJIA: +4.2%S&P 400: +1.6%Russell 2000: +0.4%

Data review:

Total housing starts in June rose by 4.6% from the prior month to a seasonally adjusted annual rate of 1.321 million units (consensus: 1.300 million). That's the good news.

The bad news is that single-family housing starts dropped by 4.6% month-over-month.

Total building permits increased by 0.2% from May to an annual rate of 1.397 million units (consensus: 1.383 million). That's the good news.

The bad news is that single-family building permits fell by 3.7% from the prior month. The key takeaway from the report is that neither single-family housing starts nor permits showed growth—precisely where growth is needed to help ease affordability constraints in the resale market, which still suffers from a relatively low supply of homes for sale.

The University of Michigan's preliminary consumer sentiment index for July ticked up slightly to 61.8 (consensus: 61.5) from June's final reading of 60.7, marking the highest level in five months. A year earlier, the index stood at 66.4.

The main takeaway from the sentiment report is that while consumer confidence remains subdued, it has improved in recent months, along with inflation expectations.

Energy: Brent crude at $69.20.

Conclusion: Despite active selling pressure, the US market is holding near its highs. In case of a pullback, we'll be watching for new buying opportunities.