The euro continues to show steady growth against the dollar, which may seem irrational at first glance, but there are significant reasons behind this. Let's examine them.

Today, the European Central Bank (ECB) is holding its monetary policy meeting. It is expected that the central bank will leave all monetary policy parameters unchanged, following eight consecutive rate cuts. Meanwhile, the Federal Reserve last lowered rates in September of last year, even before Donald Trump was elected president of the United States. There is a clear and significant divergence in interest rates between the ECB and the Fed, which typically would drive one currency higher against the other. Currently, the key interest rate in the eurozone stands at 2.15%, while in the US it is 4.5%. Yet, in the EUR/USD pair, this significant divergence is not only being overlooked, but the markets outright ignore it.

So, what's going on?

Let's first look at the positive factors for the euro. The EUR/USD pair is essentially synthetic. Its movements do not reflect the real state of the European economy but rather the relationship to the dollar based on entirely different principles. That wasn't always the case. Throughout my 25-year career, I've observed fundamental factors that influence the pair. However, the 2008–2009 mortgage crisis significantly altered how market participants evaluate the pair's growth or decline. Its upward impulse became 100% associated with risk appetite: when risk appetite increased, the dollar was sold and the euro bought, pushing the pair higher.

Additionally, the strict budgetary rules of EU member states prevented debt burdens from growing—unlike in the US, where debt has been rising steadily since the presidency of George W. Bush. Germany's strong economy used to pull the rest of the EU with it. That was then—and it seems those days are gone, if not forever, then for a long time.

Currently, the primary factor supporting the euro—outweighing all the European negatives—is the expectation of substantial government investments in the local defense industry, amounting to around 800 billion euros. The European Parliament expects this to jumpstart the EU economy. Additionally, it is assumed that once inflation falls to the target level of 2%, the ECB will end its rate-cutting cycle. That's the surface-level view.

Now, turning to the positive factors for the dollar in the EUR/USD pair. First and foremost is the significant interest rate differential, which theoretically favors the dollar. Second, the US economy is performing much better than the European one. The US financial market is acting like a vacuum, drawing capital and manufacturing companies from Europe to the US. The dollar remains the world's reserve currency, unlike the euro.

Now, let's talk about the negatives for both the dollar and the euro. The primary concern for the euro is the decline in the EU economy and the inability of European companies to compete with their American counterparts due to high energy costs. The EU's destructive foreign policy toward Russia is another factor. The US is also imposing tariffs that are unfavorable to Europe—a topic likely to be discussed in upcoming talks between Washington and Brussels.

For the dollar, the negative factors include the astronomical national debt, which continues to rise with every new US president. There is also waning interest in dollar assets amid the Ukraine conflict, due to the risk that Washington could freeze dollar-denominated assets of countries that fail to align with its hegemonic policies.

Another downside for the US currency is the uncertainty surrounding American trade policy, especially in relation to major partners such as China and India. As a result, market speculators are currently choosing the lesser of two evils and favoring the euro, despite its clear fundamental weaknesses. How long this process will last is uncertain. However, it's unlikely that the pair will keep rising indefinitely based solely on the above factors. A shift in any one of them could trigger a major reversal.

What Can Be Expected in the Markets Today?

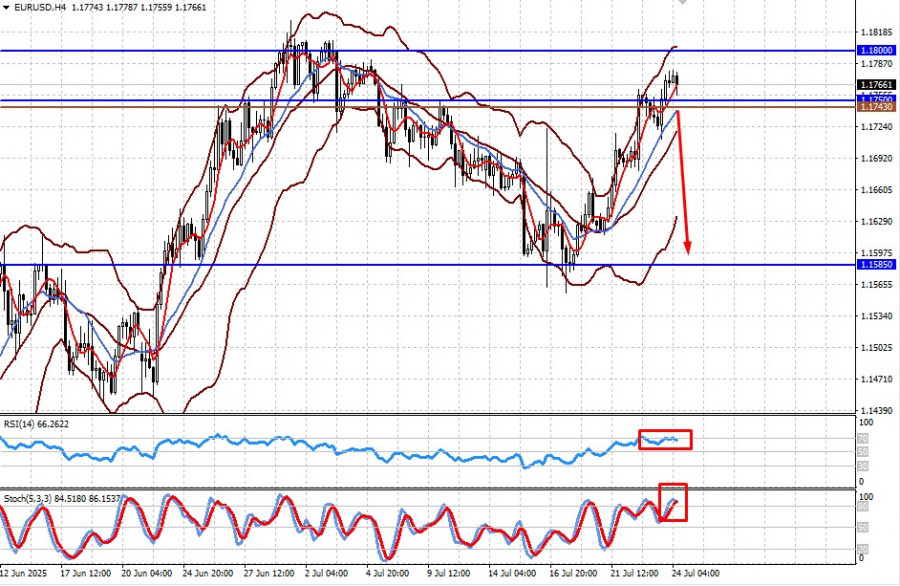

I believe that ahead of the US-EU negotiations on tariffs, the EUR/USD pair will likely remain within the 1.1675–1.1800 range, which is part of a broader 1.1585–1.1800 range.

Daily Forecasts:

EUR/USD

The pair is trading above 1.1750. A move below this level could lead to a local decline toward 1.1585, while remaining within the sideways range of 1.1585–1.1800. A potential sell level is 1.1743.

GBP/USD

The pair is moving almost in sync with EUR/USD. It could also correct lower after breaking below 1.3550, possibly dropping toward 1.3380. A potential sell level is 1.3542.