The EUR/USD currency pair maintains a bullish bias on the 4-hour timeframe. While the British pound has shown a notable decline in recent days, the euro has not, and it continues trading above the moving average line. Therefore, the upward trend remains in place for now, and further growth should be expected — especially since the price rebounded from the moving average on Friday.

From our point of view, the global fundamental backdrop continues to play a decisive role for traders. In other words, the dollar is simply not strengthening. It's important to remember that technical corrections occur not only on lower timeframes; they can also occur in the long term. Switching to the daily timeframe, it becomes evident that there is significant room for a technical correction in the euro. Thus, a new round of U.S. dollar growth could easily begin purely on technical grounds. In that case, the price would break below the moving average again, signaling a readiness for a new downward movement.

The global trade war continues to exert significant long-term pressure on the dollar. In our opinion, Donald Trump's trade deals — with Japan or Vietnam, for example — have no beneficial impact on the dollar. We say this because these deals impose the same tariffs that were in place before they were signed. In effect, it's just "more of the same." Moreover, in most cases (if such a phrase can apply to a mere four trade agreements), tariffs actually become higher after these deals. As a result, there is no real truce, tariffs remain in place, and these agreements hold little value in terms of strengthening the U.S. currency.

The macroeconomic background still holds virtually no importance for traders, as it is overshadowed by global fundamental themes. Next week, the EU will publish Q2 GDP reports, unemployment figures, and inflation data — but these releases will have little impact. The European economy may slow to 0% growth in Q2, which is not surprising given the trade war with the U.S. However, the eurozone economy has shown weak growth for years, and in 2025 this no longer matters for the euro.

The same goes for the important inflation report. Inflation has fallen to 2% in Europe and may now fluctuate slightly around this level. Since the Consumer Price Index has stabilized, it no longer influences the European Central Bank's monetary policy. The ECB has officially paused its easing cycle, and this pause could last a long time. Furthermore, in 2025, even the monetary policies of the ECB or the Federal Reserve have no real influence on the euro's exchange rate. Therefore, all the upcoming eurozone reports may provoke local market reactions, but they will not change the overall picture. The U.S. dollar could continue strengthening — but only on the technical grounds suggested by the daily timeframe.

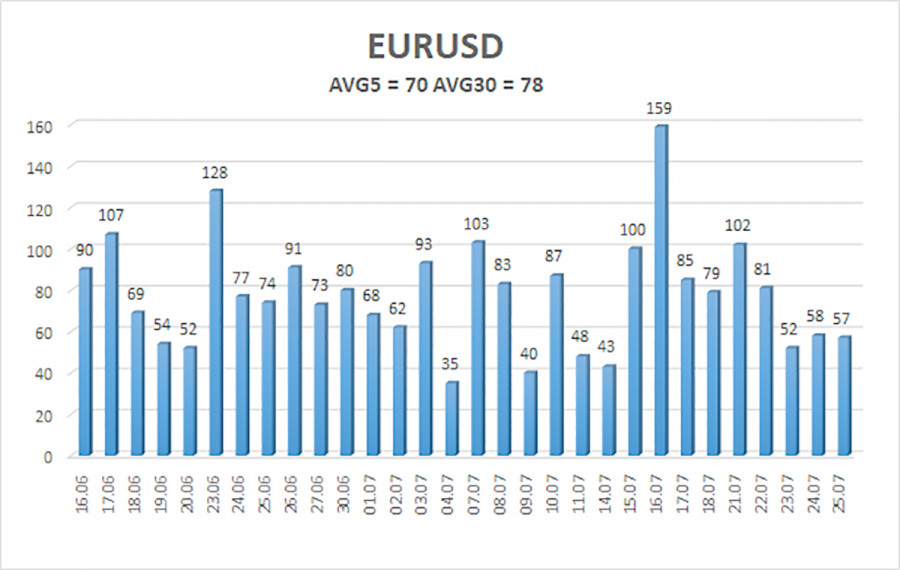

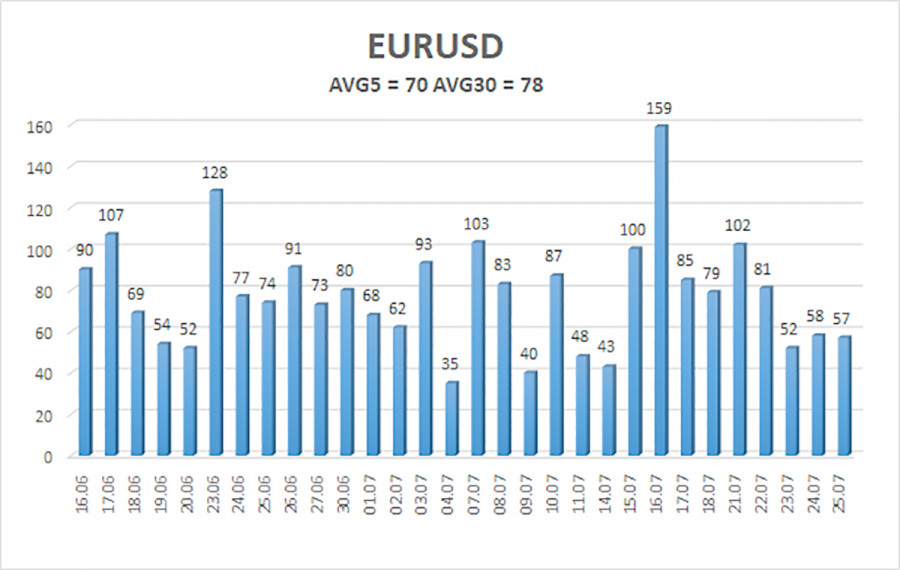

The average volatility of the EUR/USD pair over the last five trading days as of July 27 is 70 pips, classified as "moderate." We expect the pair to move between the levels of 1.1673 and 1.1813 on Monday. The long-term linear regression channel is pointing upward, confirming the ongoing uptrend. The CCI indicator recently entered the oversold area, signaling a potential resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

Nearest Resistance Levels:

R1 – 1.1780

R2 – 1.1841

Trading Recommendations:

EUR/USD has resumed its upward trend. At the very least, the price has stabilized above the moving average and continues heading north. Trump's policies — both foreign and domestic — remain the dominant force impacting the dollar. Despite a slight increase in the dollar over recent weeks, we still do not see grounds for medium-term buying. If the price falls below the moving average, short positions may be considered with targets at 1.1658 and 1.1597, based purely on technical factors. As long as the price remains above the moving average, long positions remain relevant, with targets at 1.1780 and 1.1813 in line with the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.