The GBP/USD currency pair continued to decline on Monday. The British pound began its downward movement last week, and at that time, we concluded that purely technical factors were behind it. We still hold that view, as the weakness of all corrections over the past six months is visible on the higher timeframes. Thus, the pound sterling could fall another 300–400 pips, and it would still be considered a standard technical correction.

However, on Monday, the U.S. dollar received strong support. As already mentioned, Donald Trump — in whom we had little faith — nonetheless signed a highly favorable trade agreement with the European Union, which triggered a sharp surge in demand for the U.S. currency. Understandably, the deal with the EU is only indirectly related to the United Kingdom; however, since the dollar began rising across the board, investors and traders have started shifting out of other currencies in favor of the dollar, and the pound has suffered as a result.

But now things get more interesting. Donald Trump has signed one of the two most critical trade agreements — with the European Union, which accounts for one-third of global trade by volume. The only major partner left to settle with is China. If that deal is secured, all other agreements will pale in comparison. Notably, the U.S. and China agreed on Sunday to extend the "tariff truce" by another three months. Beijing and Washington didn't reach a final deal, so they will continue negotiations during this extension, with tariffs remaining minimal in the meantime.

Since Trump managed to pressure the EU into a deal, it's reasonable to assume that a deal with China is also possible. If so, the White House will have every reason to declare victory. The key question now is: how far can the U.S. dollar recover? Logically, it could rise back to the levels from which it began to fall — roughly 1.22–1.23. The fundamental backdrop on Monday changed almost 180 degrees, but is that one factor enough for the dollar to gain 1,000 pips?

As we've said before, in our opinion, no, that's unlikely. The dollar had been plummeting for six months, mainly due to the trade war initiated by Trump. The first five trade agreements showed that the trade war simply shifted form. Now it is being waged under the guise of trade deals that still include the same tariffs as before. Likely, traders were pricing in worst-case trade war scenarios — so now there's room for relief. The U.S. dollar may indeed gain several hundred pips, but expecting a full return to prior highs would be overly optimistic. We believe the dollar could strengthen toward the 1.30–1.32 area, but further growth would require stronger justifications. For now, the daily timeframe indicates a continued technical correction, rather than a new downtrend.

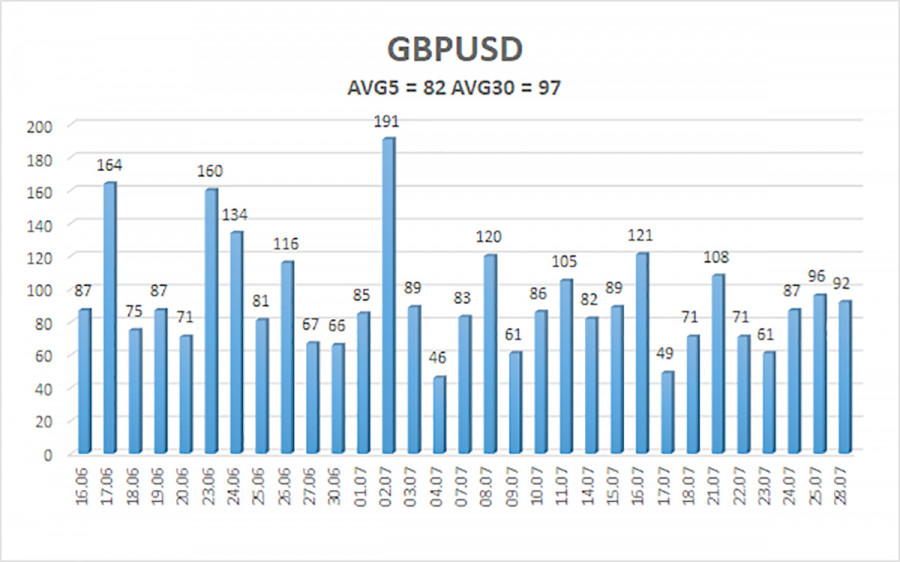

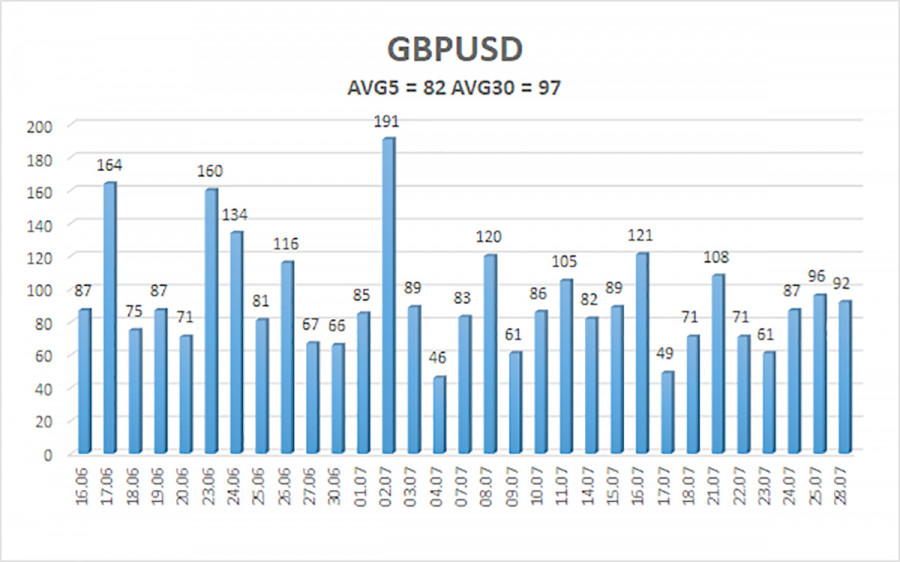

The average volatility of the GBP/USD pair over the last five trading days stands at 82 pips, which is considered "moderate." Therefore, on Tuesday, July 29, we expect movement within the range defined by 1.3289 to 1.3453. The long-term linear regression channel is pointing upward, confirming a sustained upward trend. The CCI indicator has entered oversold territory twice, signaling a potential resumption of the uptrend. A new corrective wave has now begun.

Nearest Support Levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest Resistance Levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair has resumed its downward technical correction. In the medium term, Trump's policies are likely to continue exerting pressure on the dollar. As such, long positions targeting 1.3550 and 1.3611 remain relevant as long as the price stays above the moving average. If the price remains below the moving average line, small short positions targeting 1.3306 can be considered based on technical grounds. Occasionally, the U.S. dollar shows corrective strength, but for a sustained uptrend, evident signs of a complete end to the global trade war are required — something that may now be impossible.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.