Analysis of Trades and Trading Tips for the Euro

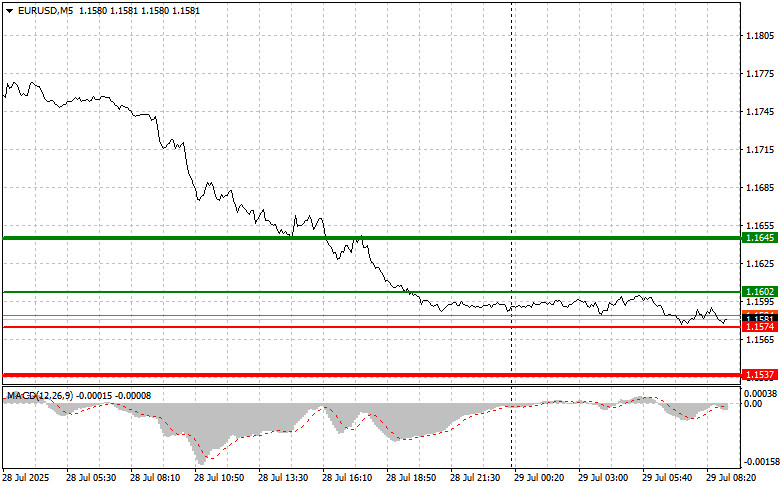

The test of the 1.1649 price level coincided with the MACD indicator just beginning to move down from the zero line, confirming a valid entry point for selling the euro, which resulted in a drop of over 50 points.

Concerns among European officials about the outlook for their countries following the EU-US trade agreement led to a decline in the euro against the dollar. The agreement turned out to be less favorable than initially expected. Investors, concerned about the economic stability of the eurozone, began actively selling the euro in favor of safer assets, such as the US dollar and the Swiss franc. According to experts, the main reason for the euro's depreciation was disappointment with the terms of the trade deal with the US. Initial expectations of lower tariffs were replaced by the realization that the agreement contains provisions that could harm European industry and agriculture. Particularly troubling is the potential decline in the competitiveness of European goods in the American market and the possible influx of cheaper US products into the European market.

As for today, the market's focus will be on the release of Spanish GDP data, making a significant short-term rise in the euro unlikely. However, even modest positive news from Spain could temporarily support the euro, especially in the current pessimistic environment.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Buy the euro today if the price reaches the area around 1.1602 (green line on the chart), targeting a rise to 1.1645. At 1.1645, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Any form of strengthening of the euro today is likely to be corrective.

Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1574 price level, when the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a market reversal upward. A rise to the opposite levels of 1.1602 and 1.1645 may be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches the 1.1574 level (red line on the chart). The target is 1.1537, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move in the opposite direction). Selling pressure on the pair may return at any moment today.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1602 price level, when the MACD indicator is in the overbought area. This would limit the pair's upside potential and lead to a downward market reversal. A decline to the opposite levels of 1.1574 and 1.1537 may be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.