Trade Analysis and Recommendations for the Euro

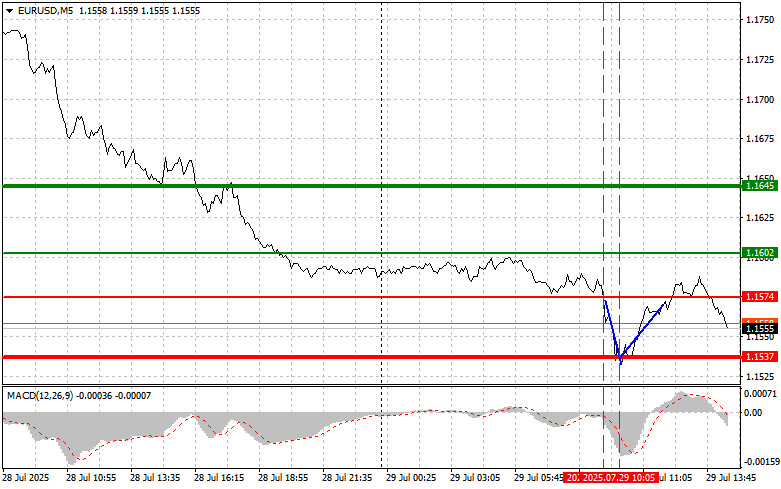

The test of the 1.1574 level occurred when the MACD indicator had just started moving down from the zero mark, confirming a valid entry point for selling the euro. As a result, the pair dropped toward the target level at 1.1537. Buying from that level on a rebound allowed for a profit of approximately 20 points.

Many analysts are once again discussing the possibility of further monetary easing by the European Central Bank, as the trade agreement with the U.S. may significantly hinder the growth of the European economy. Additional pressure on the euro today also came from political uncertainty in several EU countries, where many are opposed to the new agreement.

During the U.S. session today, the release of economic data from the United States may support the dollar. Key indicators to watch include job openings and labor market trends from the U.S. Bureau of Labor Statistics, the Consumer Confidence Index, and the goods trade balance. An increase in job openings and stable employment levels typically indicate a healthy labor market, which is positive for the dollar. The Consumer Confidence Index reflects consumers' assessment of current and future economic conditions and directly affects spending, which in turn influences economic growth. The trade balance shows the difference between exports and imports; a shrinking trade deficit can support the dollar, signaling increased global competitiveness of U.S. goods.

If the released data meets or exceeds expectations, it will likely strengthen the dollar and renew downward pressure on the EUR/USD pair. Traders will closely analyze the data to assess the resilience of the U.S. economy and the outlook for the Federal Reserve's monetary policy, which will become clearer after tomorrow's FOMC meeting. Conversely, if the data disappoints, the euro may see short-term support. However, long-term prospects will likely remain in the dollar's favor, considering the fundamental differences in economic growth rates and monetary policy paths between the U.S. and the eurozone.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

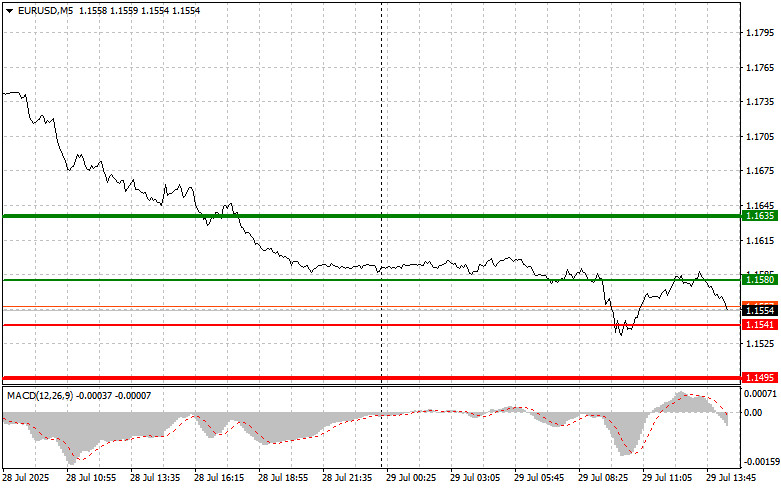

Scenario #1: Buy the euro today at 1.1580 (green line on the chart), with a target at 1.1635. I plan to exit the market at 1.1635 and open a short position from there, aiming for a 30–35 point pullback. A strong bullish move in the euro is unlikely today. Important: Before buying, ensure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the euro if the price tests 1.1541 twice in a row, while the MACD is in oversold territory. This should limit the downward potential and lead to a market reversal upward, with expected growth to 1.1580 and 1.1635.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1541 (red line on the chart). The target will be 1.1495, where I plan to exit and open a buy position in the opposite direction (expecting a 20–25 point rebound). Downward pressure on the pair is likely to persist today. Important: Before selling, make sure the MACD indicator is below the zero mark and just starting to move down.

Scenario #2: I also plan to sell the euro if the price tests 1.1580 twice in a row, while the MACD is in overbought territory. This will likely cap the pair's upward potential and lead to a reversal downward, targeting 1.1541 and 1.1495.

What's on the chart

- Thin green line – Entry price for buying the instrument.

- Thick green line – Suggested Take Profit level, or where you may lock in profits; further growth above this level is unlikely.

- Thin red line – Entry price for selling the instrument.

- Thick red line – Suggested Take Profit level, or where you may lock in profits; further decline below this level is unlikely.

- MACD Indicator – Use overbought and oversold zones as guidance when entering the market.

Important for Beginner Traders:

Forex beginners must exercise great caution when entering the market. It is often best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize risk. Trading without stop-losses may result in rapid loss of your deposit, especially if you neglect money management and trade large volumes.

And remember: successful trading requires a clear plan, like the one provided above. Making spontaneous decisions based on the current market situation is a losing strategy for intraday traders.