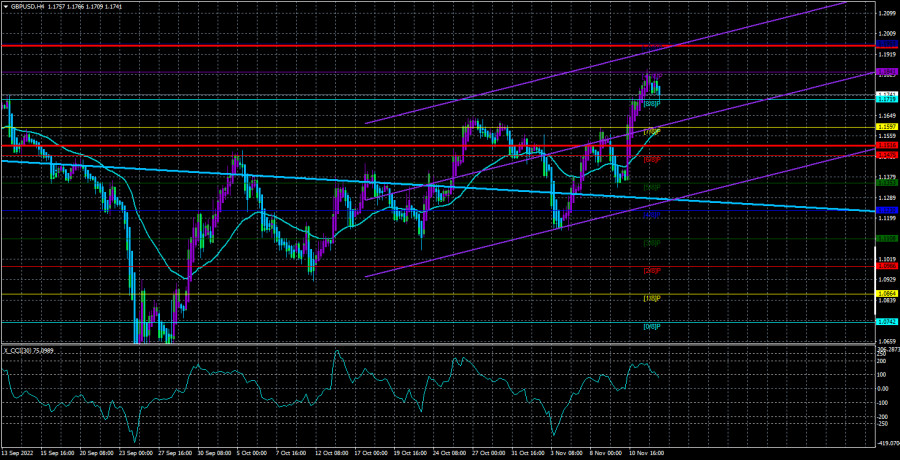

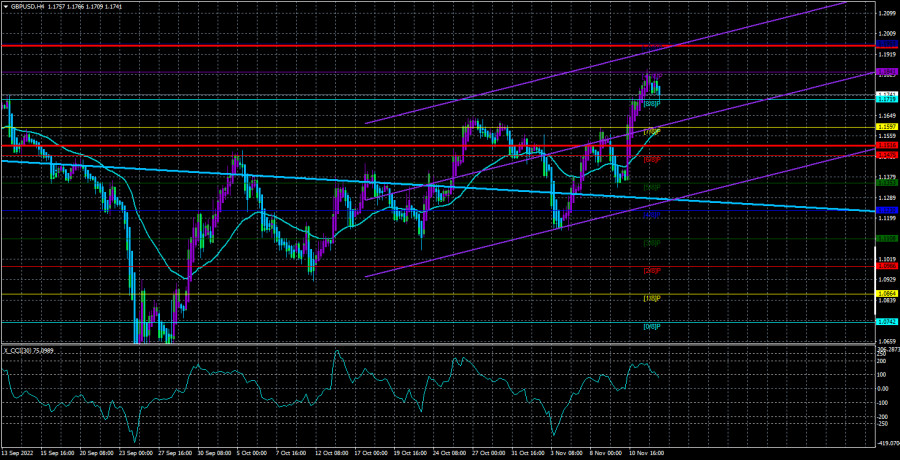

The GBP/USD currency pair also showed no desire to move volatile on Monday. The price continues to be above the moving average line, and at least one linear regression channel is already directed upwards. As in the case of the euro currency, the pound overcame the important lines of the Ichimoku indicator on the 24-hour TF, so it has technical grounds for continuing growth in the medium term. However, there are a lot of questions about the "foundation" and geopolitics. What will happen if the conflict in Ukraine escalates with renewed vigor? What will happen if the Bank of England stops raising the rate in the near future? Recall that the military conflict between Ukraine and Russia has not been completed or frozen, and peace talks are not even "smelling" now. The APU is gradually moving forward, but this hardly means that the Russian army will turn back, which would end the conflict. New rocket attacks on Ukrainian cities are not excluded, the use of new weapons is not excluded, and the intervention of third countries directly into the conflict is not excluded. I don't even want to talk about sanctions because the parties have already introduced almost everything that could have been introduced. We can assume that the worst is over, but the probability of this is not 100%.

The same is true with the Bank of England and its monetary policy. The British regulator has already raised the rate eight times in a row, and inflation has been growing and continues to grow. The key rate at the moment is already 3%; this is the value at which it is possible to expect at least a slight slowdown in price growth. However, this week, the next inflation report will be published and judging by the forecasts, there is no point in expecting something good from it. Currently, inflation in the UK is 10.1%, and forecasts for October indicate a new increase to 10.7–11.0%. Consequently, the Bank of England can be expected to tighten monetary policy by another 0.75% in December, but to what extent can it raise the rate? After all, its economy is also going through hard times.

So far, it is unclear how the British government will close the "hole" in the budget by 50 billion pounds. The corresponding financial plan from Jeremy Hunt and Rishi Sunak will be presented only on November 17. Most likely, taxes will be raised, which may cause serious discontent among the British population and significantly lower the ratings of the Conservative Party. Therefore, the BA does not have the opportunity, like the Fed, to raise the rate as much as it wants.

British inflation is the most important report of the week.

In the UK, the unemployment rate, changes in average wages, and retail sales will also be published this week. Of course, these reports do not match the inflation report, so we associate the main market reaction with this report. A new increase in the consumer price index can support the pound, as it will likely mean a new increase in the BA rate in December by another 0.75%. But this is just a theory and an assumption, and the market can react as you like. And also, no one can know if this report has not already been worked out because it is very easy and simple to expect a new acceleration of inflation in Britain now.

In the US, retail sales, industrial production, and data on applications for unemployment benefits will be released this week. Also, quite secondary are the reports. With such a macroeconomic background, it will be difficult for the pair to continue growing, which now largely depends on traders' expectations for the Fed and BA rates. We expect a tangible correction after the "take-off" last week. The pound has recovered from its absolute lows by 1400 points and is regularly adjusted downwards. Therefore, this week is a good time for a rollback. As for the longer-term prospects, the pound may continue to grow, but we do not expect a rapid recovery after losses over the past year and a half. Most likely, periods of growth and rather deep corrections will alternate. The pound still needs to look like a stable and safe currency.

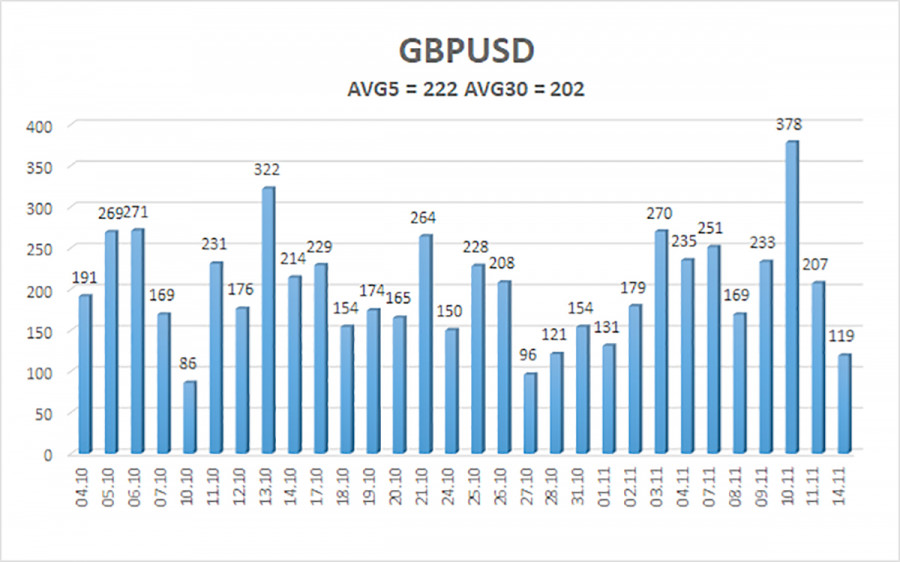

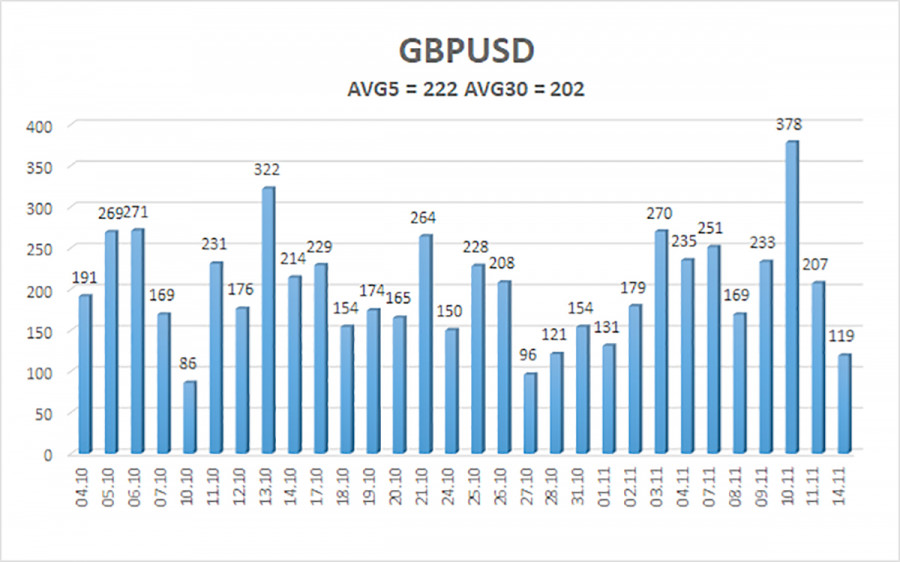

The average volatility of the GBP/USD pair over the last five trading days is 222 points. For the pound/dollar pair, this value is "very high." On Tuesday, November 15, thus, we expect movement inside the channel, limited by the levels of 1.1516 and 1.1954. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

Trading Recommendations:

The GBP/USD pair has started a minimal correction in the 4-hour timeframe. Therefore, at the moment, buy orders with targets of 1.1841 and 1.1960 should be considered in the case of a reversal of the Heiken Ashi indicator upwards. Open sell orders should be fixed below the moving average with targets of 1.1475 and 1.1353.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.