The GBP/USD currency pair gained over 100 points on Thursday, despite an empty event calendar and a lack of actual events and publications. It is unlikely that the market started reacting to the highly important report on US unemployment claims from the morning. The growth was explosive, and usually, such movements are supported by strong fundamental background. Even Nonfarm Payroll reports do not always trigger such powerful movements. Since the euro currency was also rising yesterday, it can be assumed that the issue lies with the dollar. However, as we have already mentioned, there has yet to be any important news from across the ocean.

In the article about the euro currency, we mentioned that the growth could have been triggered solely by technical factors. The same could be true for the pound, but the British currency is growing stronger than the euro and declining slowly. While the euro currency has experienced a significant decline over the past month and a half and has only shown weak growth, the pound is again close to its local and yearly highs, from which it has struggled to break away. Therefore, we maintain our previous opinion that any growth of the pound sterling is completely unjustified.

Alternatively, a new version has emerged: the market, particularly its major players, possesses some insider information regarding the Bank of England's future monetary policy plans. This must be partially ruled out, but recent information from the BOE has yet to be available. It would be logical if Mr. Bailey spoke up this week and made a statement similar to Jerome Powell's half a year ago. But nothing of the sort has happened! The pound showed a 100-point growth out of nowhere.

Is the market anticipating further tightening?

A major issue for traders is the uncertainty surrounding the Bank of England. Its representatives rarely provide comments, and Andrew Bailey speaks in public twice a month. And his rhetoric is usually very reserved, lacking hints and suggestions. Thus, we can only rely on our analysis. And this analysis suggests the following: the British regulator has already raised the key rate 12 times, bringing it to 4.5%. Inflation only showed its first significant decline in April, and the British economy stagnated for three consecutive quarters. This combination of factors openly indicates that the regulator is approaching the end of its tightening cycle.

However, experts from ING hold a different opinion and stated yesterday that the market expects the Bank of England to raise the rate by another 1%, reaching 5.5%. If this is true, the high demand for the pound is quite explainable. And such an opinion has a right to exist, as inflation in the UK is still high and extremely high. However, we believe that these experts forget that the British economy could easily fall into a recession at such a rate level, and the government and the regulator would like to avoid a contraction of the economy, which has already been teetering on the edge for several quarters.

In general, we do not believe in such forecasts. If such plans did exist, the BOE should not have slowed down the pace of tightening to a minimum. What makes sense to raise the rate by 0.25% in four sessions when it could be raised by 0.5% in two sessions? After all, many economists have already stated that central banks should not have waited for high inflation figures. Monetary policy should have been tightened once the consumer price index exceeded permissible levels. And the Bank of England, which has already raised the rate 12 times, clearly only cares a little about the economy if it is preparing to raise it another four times. Therefore, it may care if it has slowed the increase to a minimum.

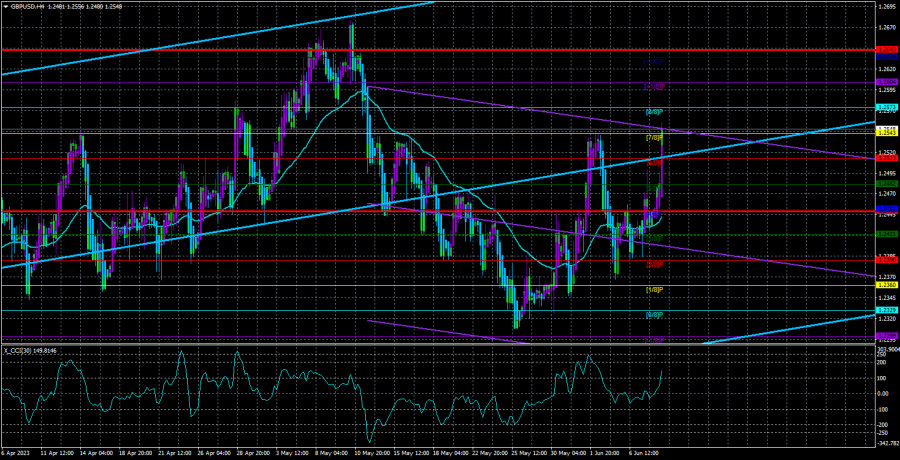

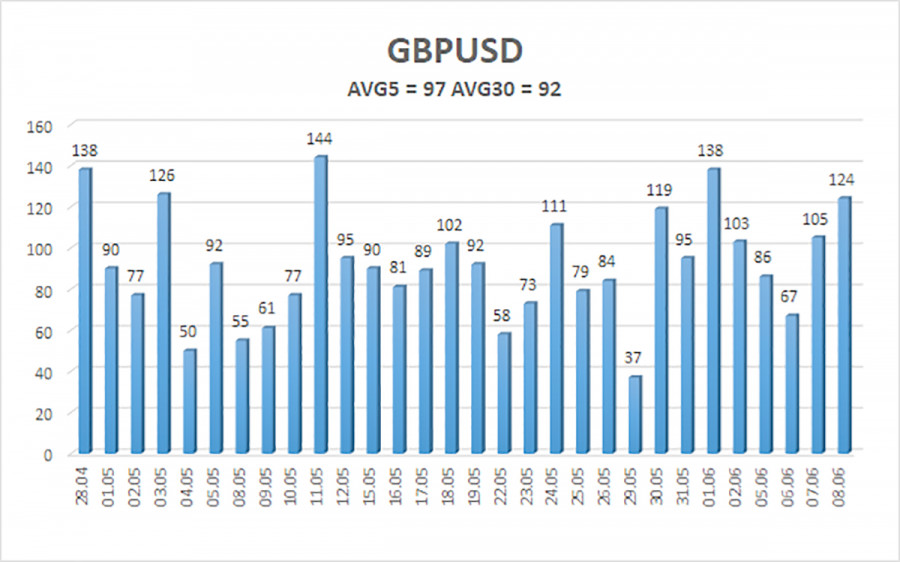

The average volatility of the GBP/USD pair over the past five trading days is 97 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, June 9, we expect movements within the range limited by the levels of 1.2449 and 1.2643. A reversal of the Heiken Ashi indicator back down will signal a new downward movement.

Nearest support levels:

S1 - 1.2543

S2 - 1.2512

S3 - 1.2482

Nearest resistance levels:

R1 - 1.2573

R2 - 1.2604

R3 - 1.2634

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair has re-established itself above the moving average line, so long positions are currently relevant with targets at 1.2573 and 1.2604, which should be held until the Heiken Ashi indicator reverses downwards. Short positions can be considered if the price firmly settles below the moving average with targets at 1.2390 and 1.2360. There is also a high probability of "choppy" price action.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. It indicates a strong trend if both channels are in the same direction.

Moving average line (settings 20, 0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an upcoming trend reversal in the opposite direction.