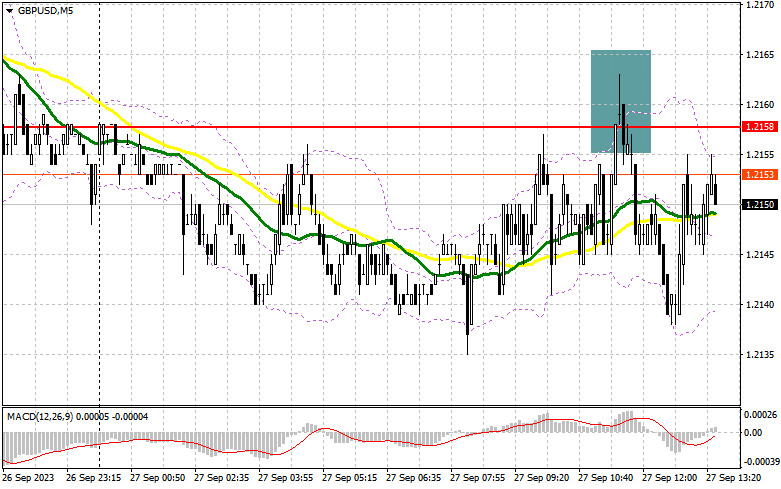

In my morning forecast, I drew attention to the level of 1.2158 and recommended making entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. Growth and the formation of a false breakout around 1.2158 led to a selling signal, resulting in a 20-point downward movement in the GBP/USD pair. Considering that the trend is bearish, we can expect the GBP/USD to continue its descent. For this reason, the technical picture has slightly changed for the second half of the day.

To open long positions on GBP/USD, the following is required:

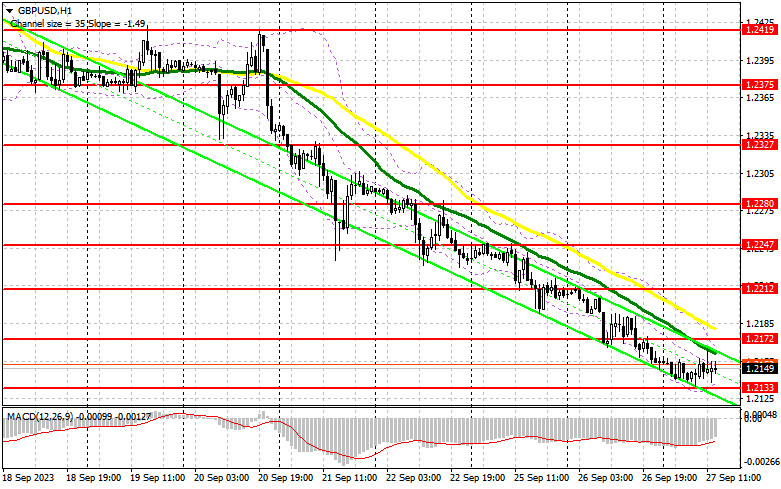

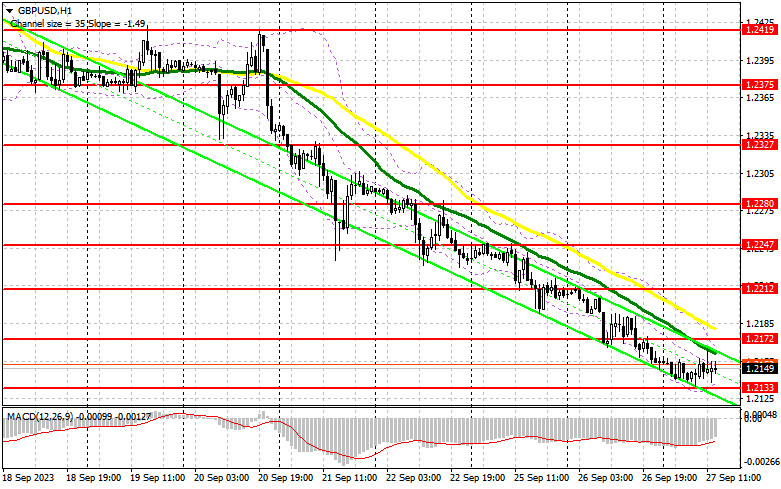

The further direction of the pound depends on the reaction to US statistics. However, even weak data can lead to further declines in the pair, similar to what happened yesterday. We have upcoming figures on the change in the volume of orders for durable goods, and an increase in this indicator will be a good reason to increase short positions. For this reason, bulls need to make a significant effort to avoid breaking below the new support level of 1.2133, formed in the first half of the day. A false breakout at this level will provide an entry point for long positions, anticipating a correction to 1.2172, where the moving averages are located, favoring the bears. A breakthrough and consolidation above this range will restore buyer confidence, signaling the opening of long positions with an exit at 1.2212, where I expect the presence of larger sellers. The ultimate target will be the area of 1.2247, where I will make profits. In the scenario of a decline to 1.2133, as well as the absence of buyer activity in the second half of the day, which is more likely to happen, the pressure on the pound will only increase. In this case, only protection at 1.2080, as well as a false breakout there, will provide a signal to open long positions. I plan to buy GBP/USD immediately on a bounce only from the minimum of 1.2028, with the goal of a 30-35 point intraday correction.

To open short positions on GBP/USD, the following is required:

In the event of GBP/USD rising in the second half of the day, short positions around the new resistance of 1.2172, where the moving averages are already located, will be the optimal scenario. Therefore, if GBP/USD makes an upward move, there will be a battle for this level. The target in this case will be the new local minimum of 1.2133. A breakthrough and a reverse test from bottom to top of this range against the backdrop of strong US data, as well as hawkish statements by FOMC member Neel Kashkari, known for his tough stance, will deal a new serious blow to bullish positions, providing an opportunity for a drop to support at 1.2080. The more distant target remains the area of 1.2028, where I will take profits. In the scenario of GBP/USD rising and the absence of activity at 1.2172 in the second half of the day, buyers will have an excellent opportunity to build an upward correction, which has been pending for quite some time. In this case, I will postpone selling until a false breakout at 1.2212. If there is no downward movement at that level, I will sell the pound immediately on a bounce from 1.2247, but only with the expectation of a 30-35 point intraday correction.

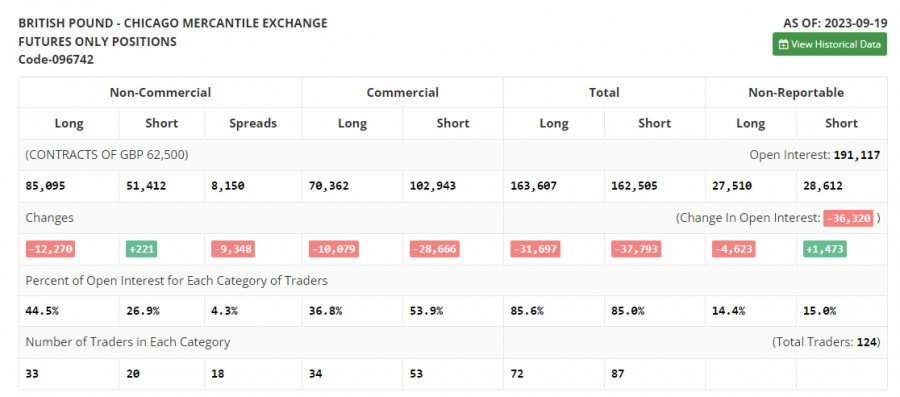

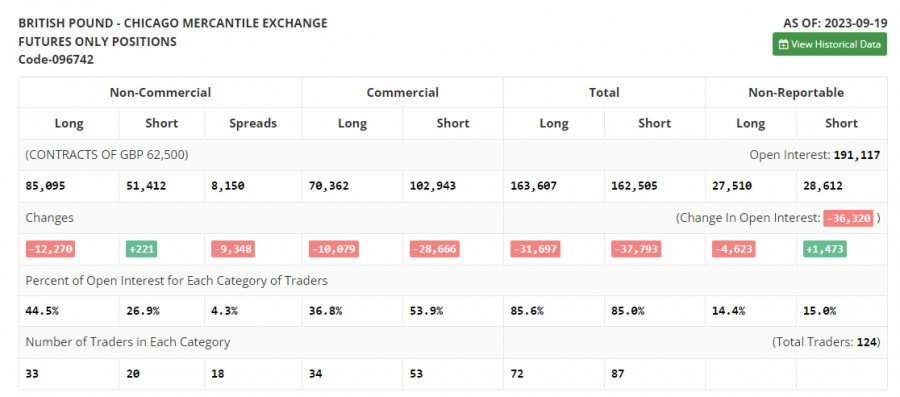

In the COT (Commitment of Traders) report for September 19, there was a reduction in long positions and a minimal increase in short positions. This indicates that there are fewer pound buyers, but there is no clear increase in sellers. The released data on the reduction in inflation in the UK influenced the decision of the Bank of England, which left interest rates unchanged, surprising many. Traders perceived this news as negative since the regulator seems to be at the peak of its rate hike cycle, making the pound less attractive in this position. Considering that the UK's economy could demonstrate a sharp slowdown in the third quarter, it's not surprising why the pound is actively falling against the US dollar. In the latest COT report, it is stated that long non-commercial positions decreased by 12,270 to 85,095, while short non-commercial positions increased by only 221 to 51,412. As a result, the spread between long and short positions decreased by 9,348. The weekly closing price fell to 1.2390 from 1.2486.

Indicator Signals:

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator around 1.2133 will act as support.

Description of Indicators:

Moving Average (a moving average that determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.Moving Average (a moving average that determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.Bollinger Bands (Bollinger Bands). Period 20.Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The total non-commercial net position is the difference between the short and long positions of non-commercial traders.