You require the following to open long positions on the GBP/USD:

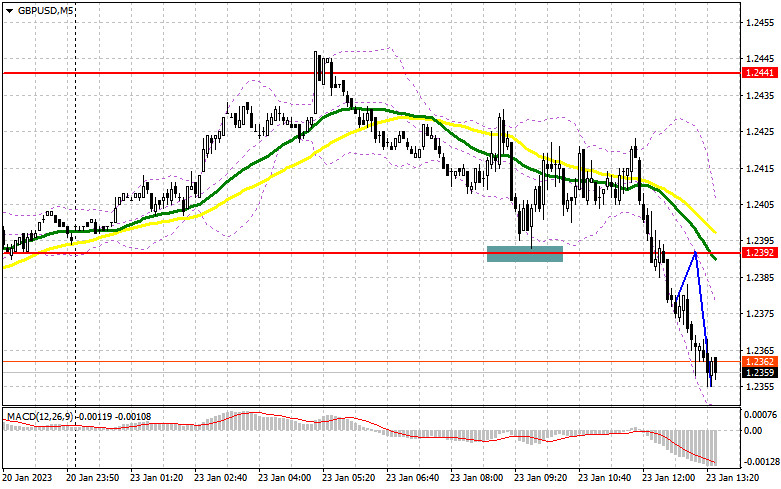

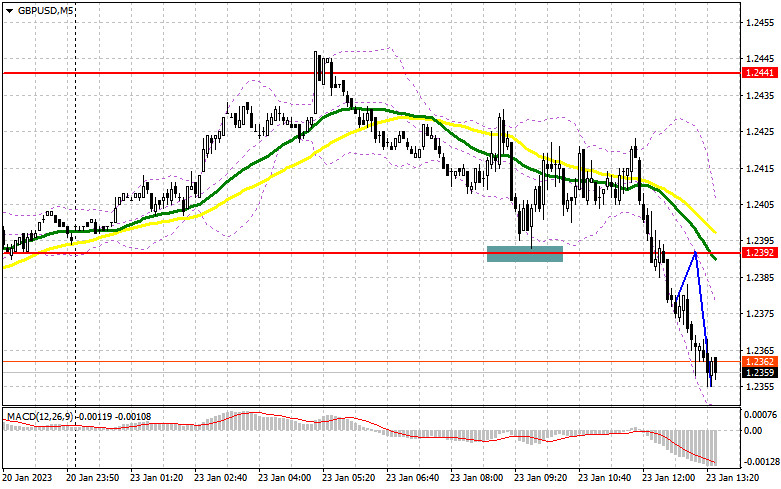

Only one indication to enter the market was produced in the morning. Let's analyze the 5-minute chart to see what transpired there. The pound rose by 30 points as a result of the drop and the construction of a false breakdown in the area of 1.2392, but we were unable to reach the target in the vicinity of 1.2441. Then, during the subsequent test of 1.2392, this level was broken, but I was unable to sell GBP/USD since I did not observe a reversal test from this range's bottom-up.

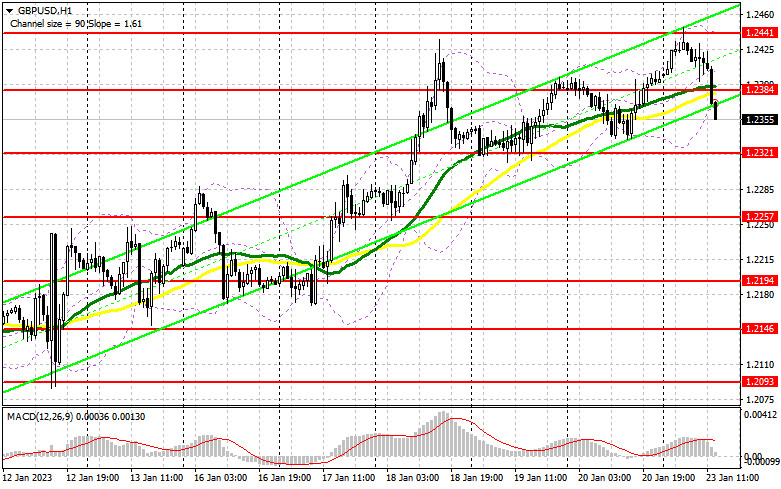

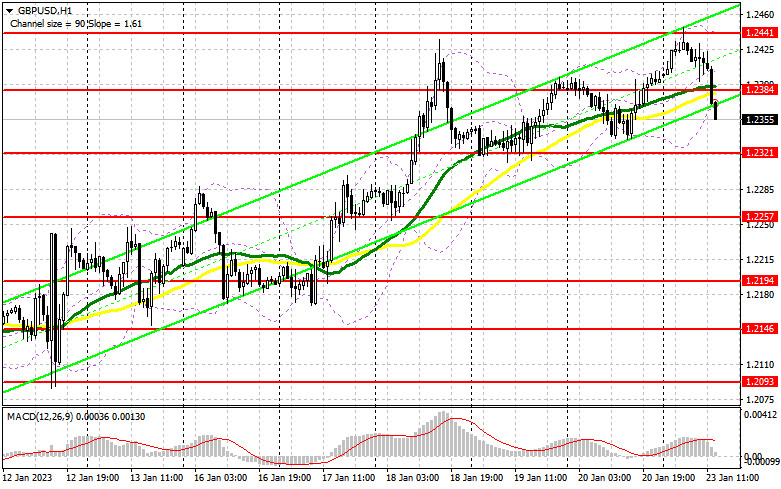

There are no figures that could have a significant impact on the pair in the second half of the day, so the pressure on the pound will probably persist. Although the technological picture has undergone a thorough revision, the strategy has not changed. Only a false breakdown in the support area of 1.2221 formed after the results of the European session will allow us to count on the continued development of a strong bullish impulse and a return to 1.2384, the intermediate resistance, with the possibility of another decline in the pound based on strong data on the index of leading economic indicators in the United States. I'll wager on a stronger surge of the pound up to a maximum of 1.2441 if there is consolidation above this range following the dovish rhetoric of Fed members. At 1.2499, where I fix profits, an exit above this range with a top-down test will open up growth opportunities. The pressure on GBP/USD will intensify if the bulls are unable to complete the tasks assigned to them and miss 1.2221, which I personally strongly doubt given that is where the bottom border of the ascending channel lies. All of this will cause the market's direction to change, and the pair will float in the side channel. The best time to start long positions is on a fall or a false breakdown close to the minimum of 1.2257, so I suggest you not hurry into purchases. With the aim of a correction of 30-35 points within the day, I will purchase GBP/USD as soon as it recovers just from 1.2194.

You require the following to open short trades on the GBP/USD:

Following the upgrade of the monthly maximum during the Asian session, the sellers of the pound became fairly active. At this point, taking back control of the 1.2221 level is the main concern. It's important not to overlook the 1.2384 intermediate resistance's protection either. Only the development of a false breakdown at 1.2384 will signal the opening of short positions in the event of an upward move on bad US data, with the possibility of a new and more active decline below 1.2321. A breakout and reverse test from the bottom up of this range will eliminate the positive prospects, generating a sell signal with a rise to 1.2257. The area of 1.2194 will be my farthest aim, where I will fix the profit. The continuation of a new bullish trend will be supported by the possibility of GBP/USD growth and the lack of bears at 1.2384 in the afternoon. In this instance, the only entry opportunity into short positions to continue down is a false breakout in the vicinity of 1.2441. If there isn't any activity there, I'll sell GBP/USD right away at its highest price of 1.2499, but only if I believe the pair will fall back by 30-35 points over the day.

There was a substantial decline in long positions and a sharp increase in short positions in the COT report (Commitment of Traders) for January 10. However, you should be aware that this analysis does not account for the US inflation data that was released last Thursday. This data had a big impact on the alignment of forces, and the situation, in reality, may have since changed dramatically. The demand for risky assets, including the British pound, which is battling to maintain its growth, returned in December last year as a result of the slowing rate of price growth in the United States. This week's positive labor market statistics will help the pound maintain its position at recent highs and establish a fresh upward trend. I also suggest that you listen carefully to what the Federal Reserve System and Bank of England officials have to say. They will have a dramatic impact on central bank policy. According to the most recent COT report, short non-commercial positions increased by 1,537 to 65,463, while long non-commercial positions declined by 7,618 to 36,007, which caused the non-commercial net position's negative value to increase to -29,456 from -20,301 the previous week. It is important to note that the negative delta has risen for three consecutive weeks. This may be a sign that important players no longer think the pound will increase and are making every effort to sell their positions. Exercise caution when purchasing the pair at its current highs. Compared to 1.2004, the weekly closing price increased to 1.2182.

Signals from indicators

Moving Averages

The fact that trading occurs around the 30- and 50-day moving averages suggests that bears are trying to halt the bull market.

Note that the author's consideration of the period and cost of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2441, will serve as resistance in the event of expansion.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.