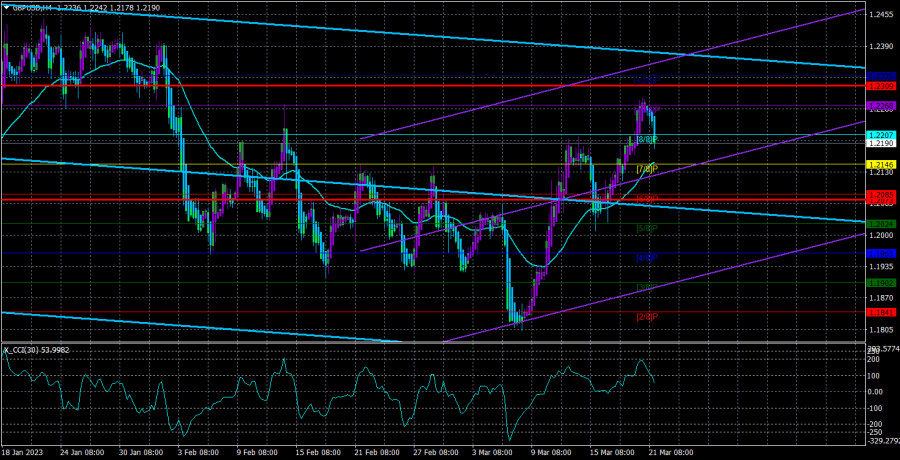

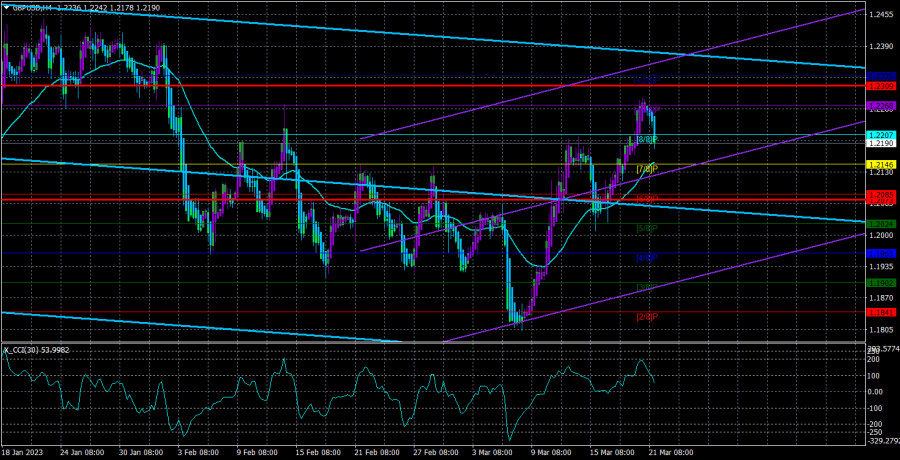

On Tuesday, the GBP/USD currency pair moved differently than the EUR/USD pair. This serves as further evidence that the euro currency is in "swing" mode with "opening amplitude" while the pound is merely in swing mode. But these differences nevertheless have the same overall meaning. The pair reached its peak on February 14 at 1.2268, as we had previously warned, and then rebounded from it. The growth may likely return merely based on technical indicators now that a modest correction has started. Remember that the highest limit of the 600-point side channel, which is still present on the 24-hour TF, is at the level of 1.2440. As a result, the pair can continue to develop at this level even in the absence of compelling fundamental reasons. But today's Fed meeting results and tomorrow's Bank of England results will be made public. These two events will have a significant impact on traders' moods, so you can expect any movement these days. However, the fact that the pound started to fall on the eve of the BA and Fed meetings may indicate that the market is getting ready for another downward reversal. If the euro has justification for a four-day increase, then the pound's movement of 450 points from the previous local minimum raises doubts.

The technical picture on the 24-hour TF is unchanged. It makes sense that the pair grew constantly after it rebounded off the side channel's lower border. The pair is now in a flat, so no long-term conclusions can be drawn. It also makes no sense to forecast movement for 1-2 days in advance when two central bank meetings are taking place on these exact days. As a result, traders now simply need to observe the scenario and react "on the spot."

What else can we discuss on the eve of the BA and Fed meetings if not interest rates? We believe that both key rates will rise by 0.25%, but we recognize that choices may differ. In reality, the market permits this as well because, according to numerous probability assessment techniques, the Bank of England can raise the rate by 0.25% with a probability of 50% and maintain it with the same likelihood. The Fed is in the same boat. As a result, today and tomorrow may indeed bring surprises.

We think the movement could be completely random. Additionally, even disregarding the current technological situation, the most long-term strategy suggests a flat. Since the Bank of England only increased the rate by 0.5% last month, we think it won't decline to do so again. As a result, if a pause is intended, it will undoubtedly have a "soft" transition into it. Regarding the Fed, the rate might theoretically stay the same, but given the strong American economy and the newly approved QE program, there is not much significance in doing so. The Fed's representatives have emphasized time and time again that maintaining price stability is the organization's primary goal. And it's unlikely that the failure of a few banks will persuade them otherwise. When interest rates increase by 0.25%, only "impulsive" or "emotional" reactions are possible. The two can alternately drop in both directions before returning to their starting positions.

Finally, we merely want to point you that the growth of the pound in recent weeks has been both excessive and sudden. The growth was nearly recoilless. This means that at least a correction to the trend can now be anticipated. However, because the pair have been doing it frequently lately, conquering the actual moving will not make much sense. Additionally, a report on UK inflation will be released this morning, which may have an impact on the market's mood as well as the attitude of the Bank of England before the meeting. Inflation is predicted to slow by a few tenths of a percent, which is very small. Furthermore, there is no way that a slight decline in inflation will raise the possibility of a more pronounced tightening of monetary policy.

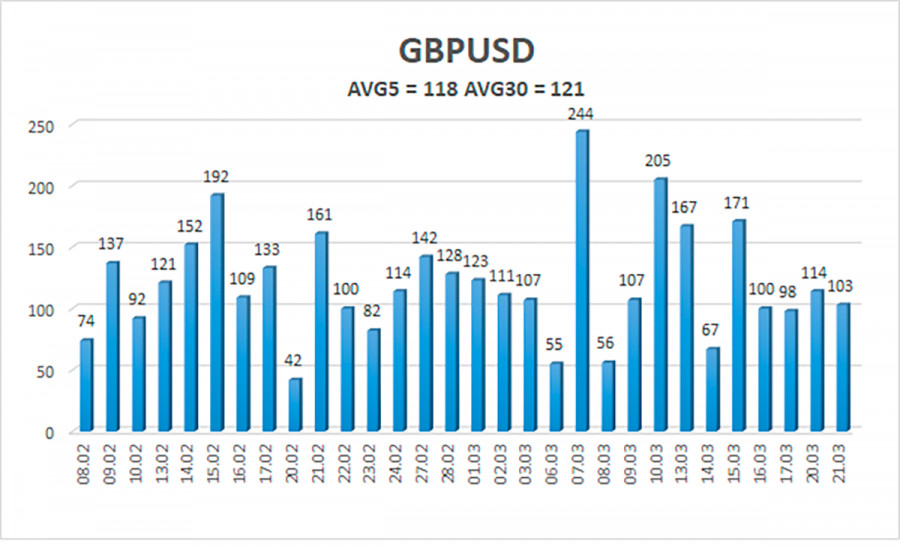

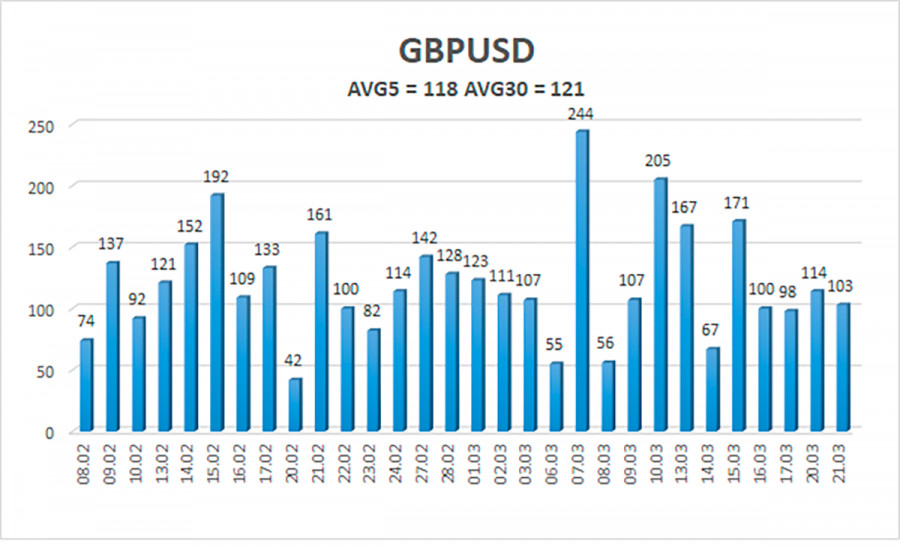

Over the previous five trading days, the GBP/USD pair has averaged 118 points of volatility. This value is "high" for the dollar/pound exchange rate. Thus, on March 22, we anticipate movement that is contained inside the channel and is limited by the levels of 1.2073 and 1.2309. The Heiken Ashi indicator's upward reversal indicates that the upward movement has resumed.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2329

Trading Suggestions:

Based on the 4-hour timeframe, the GBP/USD pair has begun a weak downward correction. Currently, long positions with targets of 1.2268 and 1.2309 can be taken into consideration if the Heiken Ashi indicator reverses its trend upward. If the price is fixed below the moving average, short positions with targets of 1.2073 and 1.2024 may be taken into account.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.