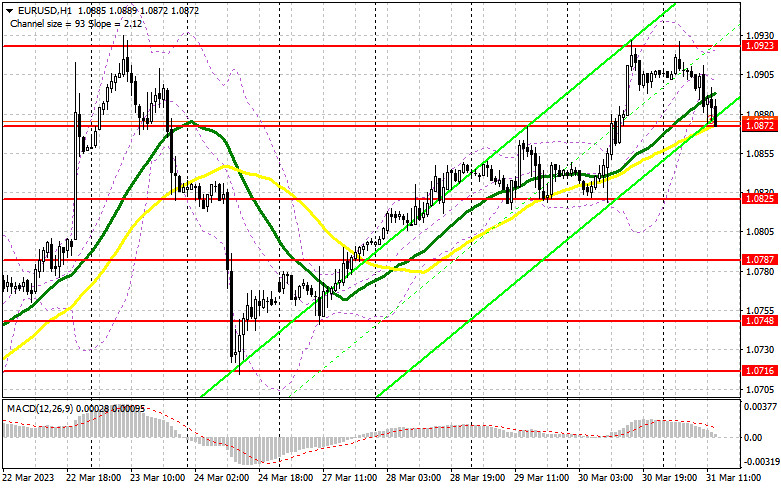

In my morning article, I turned your attention to 1.0872 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A decline and a false breakout of this level led to a buy signal. Yet, the eurozone inflation report undermined a bullish bias. After a 20-pip rise, the pressure on the pair increased. For the afternoon, the technical outlook remained the same.

When to open long positions on EUR/USD:

Inflation in the eurozone declined more than expected. However, the Core CPI rose. The ECB feared such an outcome. So, a drop in the CPI will not affect the regulator's plans to raise rates further. Do not forget that today is the end of the month, so a correction in the euro may occur. The US will also unveil a crucial economic report, namely the Core PCE Price Index. The Fed closely monitors this indicator as it shows changes in inflation. A decrease in the index will certainly weaken the US dollar and boost demand for the euro. In the meantime, I would advise you to stick to the morning scenario. In case of another decrease to the support level of 1.0872, just above which the moving averages are passing, it is better to open long positions only after a false breakout. It could provide new entry points and cause an upward movement to the monthly high of 1.0923. Only a false breakout and a downward retest of this level will lead to a buy signal with a rise to 1.0975 where I recommend locking in profits. A more distant target will be the 1.1002 level. However, it will hardly hit this level. If EUR/USD declines and buyers show no activity at 1.0872 in the afternoon, which is more likely, the pressure on the euro will increase. There could be a downward movement to 1.0825. Only a false breakout of this level will create new entry points into long positions. You could buy EUR/USD at a bounce from a low of 1.0787 or 1.0748, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers finally got the chance to regain control. However, it is too early to talk about a new downward correction. It is better to open new short positions after a false breakout of 1.0923. It may occur only after the release of weak US data. It may lead to another decline to the support level of 1.0872. A breakout and an upward retest of this level will deliver a severe blow to bulls. The pair is likely to decrease to 1.0825. A fall below this level will also push the pair to 1.0787, which will facilitate a downward correction. At this level, I recommend locking in profits. If EUR/USD rises during the American session and bears show no energy at 1.0923, I would advise you to postpone short positions until a breakout of 1.0975. You could EUR/USD only after a bounce from 1.1002, keeping in mind a downward intraday correction of 30-35 pips.

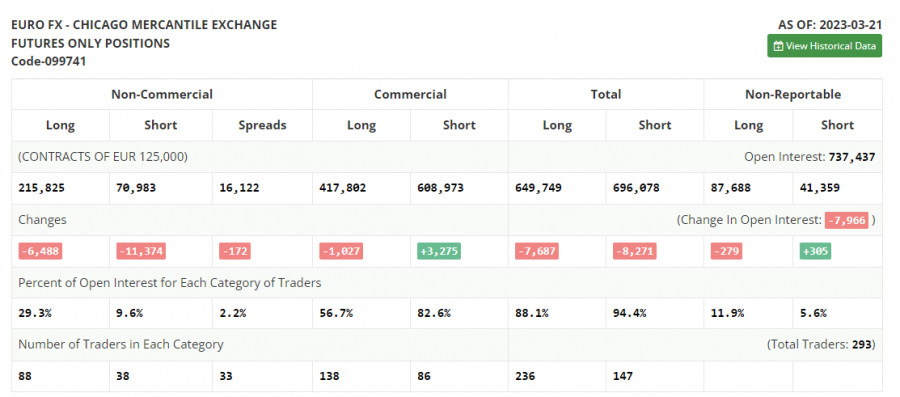

COT report

According to the COT report from March 21, the number of both long and short positions dropped. The Fed's meeting held in March affected the market situation. However, the US dollar is unlikely to slump since the regulator remained stuck to its policy. The aggressive approach of the ECB is the only fact that is supporting the euro at the moment. The central bank is planning to raise the key interest rate higher without altering its stance. Thus, the COT report unveiled that the number of long non-commercial positions decreased by 6,488 to 215,825, while the number of short non-commercial positions fell by 11,374 to 70,983. At the end of the week, the total non-commercial net position increased to 144,842 against 139,956. The weekly closing price rose to 1.0821 against 1.0803.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates a sideways movement.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.0923 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.