การวิเคราะห์การซื้อขายและเคล็ดลับการซื้อขายสำหรับเงินเยนญี่ปุ่น

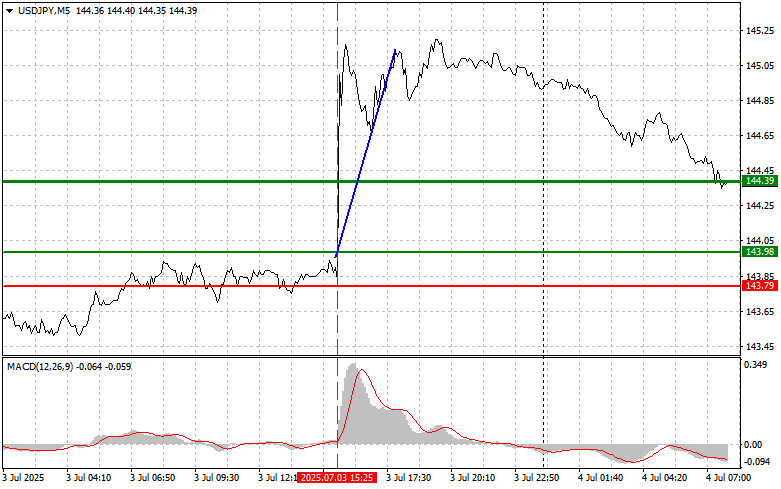

การทดสอบระดับ 143.98 เกิดขึ้นเมื่อดัชนี MACD ได้เคลื่อนตัวสูงกว่าระดับศูนย์ ซึ่งทำให้คาดการณ์ว่าศักยภาพในการขึ้นราคาของดอลลาร์จะถูกจำกัด อย่างไรก็ตามจากข้อมูลตลาดแรงงานของสหรัฐฯ ที่แข็งแกร่งซึ่งแตกต่างจากการคาดการณ์ของนักเศรษฐศาสตร์ จึงมีเหตุผลที่จะซื้อต่อดอลลาร์และคาดหวังการเคลื่อนไหวต่อไปในคู่เงิน USD/JPY ซึ่งผมได้ทำไปแล้ว ผลลัพธ์คือคู่เงินนั้นเพิ่มขึ้นกว่า 100 pip

อัตราการว่างงานของสหรัฐฯ ลดลงเหลือ 4.1% และการจ้างงานที่ไม่เกี่ยวข้องกับการเกษตรเพิ่มขึ้นถึง 147,000 คนนั้นเป็นตัวกระตุ้นให้คู่นี้เติบโต การปรับปรุงของตัวชี้วัดเศรษฐกิจมหภาคของสหรัฐฯ นี้ช่วยเสริมสถานะของดอลลาร์ในฐานะสินทรัพย์ที่น่าดึงดูดสำหรับนักลงทุนที่มองหาผลตอบแทน ความคาดหวังเรื่องนโยบายการเงินที่เข้มงวดขึ้นจาก Federal Reserve ช่วยเสริมความต้องการสกุลเงินดอลลาร์ สถานการณ์ตลาดในปัจจุบันบ่งบอกถึงศักยภาพในการขึ้นราคาของคู่เงิน USD/JPY ที่ยังคงมีอยู่ อย่างไรก็ตามนักลงทุนควรระมัดระวังและพิจารณาทุกปัจจัยที่มีผลต่อการเปลี่ยนแปลงอัตราแลกเปลี่ยนในการตัดสินใจลงทุน

วันนี้ในช่วงเซสชั่นเอเชีย ข้อมูลการใช้จ่ายครัวเรือนที่แข็งแกร่งของญี่ปุ่นได้ถูกเปิดเผย และเกินกว่าที่นักเศรษฐศาสตร์คาดการณ์ไว้ ซึ่งทำให้มูลค่าของดอลลาร์ลดลงและมูลค่าของเงินเยนญี่ปุ่นเพิ่มขึ้น การปรับปรุงในกิจกรรมผู้บริโภคของญี่ปุ่นชี้ให้เห็นถึงการฟื้นตัวของความต้องการในประเทศซึ่งเป็นปัจจัยสำคัญสำหรับการเติบโตทางเศรษฐกิจอย่างยั่งยืน การเพิ่มขึ้นของการใช้จ่ายครัวเรือนอาจเกิดจากหลายปัจจัย รวมถึงการเติบโตของค่าจ้าง อัตราการว่างงานที่ลดลง และความเชื่อมั่นของผู้บริโภคที่เพิ่มขึ้น การตอบสนองของตลาดเป็นที่คาดการณ์ได้: จากข่าวดีนักลงทุนได้ปรับพอร์ตมาด้านเยน ทำให้เยนแข็งค่าขึ้นเมื่อเทียบกับดอลลาร์ แม้จะมีข้อมูลตลาดแรงงานสหรัฐฯ ที่ดีออกมาก่อนหน้า

สำหรับกลยุทธ์การซื้อขายระหว่างวัน ผมจะเน้นไปที่การใช้สถานการณ์ #1 และ #2 เป็นหลัก

สถานการณ์ซื้อ

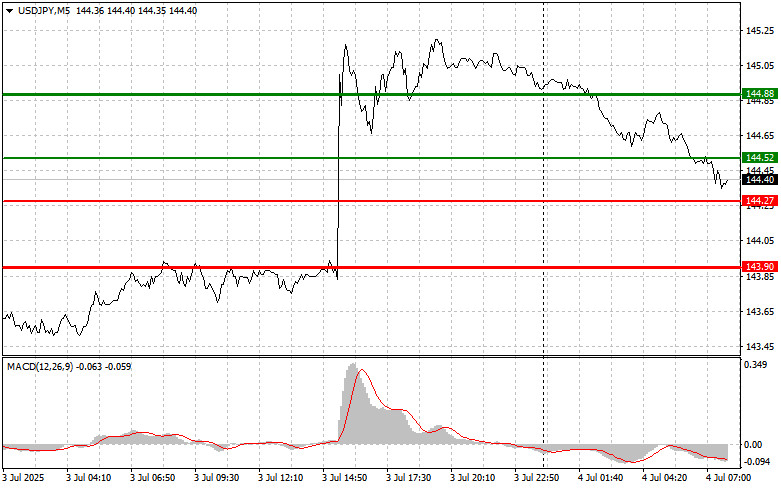

สถานการณ์ #1: ฉันวางแผนที่จะซื้อ USD/JPY ในวันนี้เมื่อถึงจุดเข้าใกล้ๆ ที่ 144.52 (เส้นสีเขียวในกราฟ) ด้วยเป้าหมายให้ขึ้นไปถึง 144.88 (เส้นสีเขียวที่หนาขึ้น) เมื่อถึงประมาณ 144.88 ฉันวางแผนที่จะปิดสถานะซื้อและเปิดสถานะขายในทิศทางตรงกันข้าม (ตั้งเป้าการถอยกลับที่ 30-35 pip) การซื้อคู่สกุลนี้ทำได้ดีที่สุดในช่วงที่มีการปรับฐานและการตกลงที่มีนัยสำคัญของอัตราแลกเปลี่ยน USD/JPY

สำคัญ! ก่อนซื้อ ตรวจสอบให้แน่ใจว่า MACD อยู่เหนือเส้นศูนย์และเริ่มมีการขึ้นมาจากเส้นนี้

สถานการณ์ #2: ฉันยังวางแผนที่จะซื้อ USD/JPY ในวันนี้ในกรณีที่มีการทดสอบระดับ 144.27 สองครั้งต่อเนื่อง เมื่อ MACD อยู่ในโซนที่ขายมากเกินไป ซึ่งจะทำให้โอกาสในการลงของคู่สกุลนี้จำกัดและส่งผลให้เกิดการกลับตัวขึ้น การคาดการณ์ว่ามีแนวโน้มที่จะขึ้นไปยังระดับตรงข้ามที่ 144.52 และ 144.88 ได้

สถานการณ์ขาย

สถานการณ์ #1: ฉันวางแผนจะขาย USD/JPY ในวันนี้เฉพาะหลังจากที่มีการแตกต่ำกว่า 144.27 (เส้นสีแดงในกราฟ) ซึ่งจะนำไปสู่การลดลงอย่างรวดเร็วของคู่สกุลนี้ เป้าหมายหลักสำหรับผู้ขายจะอยู่ที่ 143.90 ที่ซึ่งฉันตั้งใจจะปิดสถานะขายและเปิดสถานะซื้อทันทีในทิศทางตรงกันข้าม (ตั้งเป้าการเด้งกลับที่ 20-25 pip) ความกดดันในการขายต่อคู่สกุลนี้อาจกลับมาอย่างรวดเร็วในวันนี้

สำคัญ! ก่อนขาย ตรวจสอบให้แน่ใจว่า MACD อยู่ต่ำกว่าเส้นศูนย์และเริ่มมีการลงมาจากเส้นนี้

สถานการณ์ #2: ฉันยังวางแผนจะขาย USD/JPY ในวันนี้ในกรณีที่มีการทดสอบระดับ 144.52 สองครั้งต่อเนื่อง เมื่อ MACD อยู่ในโซนที่ซื้อมากเกินไป ซึ่งจะจำกัดโอกาสในการขึ้นของคู่สกุลนี้และนำไปสู่การกลับตัวลง การคาดการณ์ว่ามีแนวโน้มที่จะลดลงไปยังระดับตรงข้ามที่ 144.27 และ 143.90 ได้

สิ่งที่เห็นบนกราฟ:

- เส้นสีเขียวบางแสดงราคาเริ่มต้นที่สามารถซื้อเครื่องมือการเทรดได้

- เส้นสีเขียวหนาแสดงระดับราคาที่คาดว่าจะวางคำสั่ง Take Profit หรือดำเนินการทำกำไรด้วยมือ เนื่องจากการเติบโตของราคาที่สูงกว่าระดับนี้มีโอกาสน้อย

- เส้นสีแดงบางแสดงราคาเริ่มต้นที่สามารถขายเครื่องมือการเทรดได้

- เส้นสีแดงหนาแสดงระดับราคาที่คาดว่าจะวางคำสั่ง Take Profit หรือดำเนินการทำกำไรด้วยมือ เนื่องจากการลดลงของราคาที่ต่ำกว่าระดับนี้มีโอกาสน้อย

- ควรใช้ดัชนี MACD เพื่อประเมินโซนที่มีการซื้อมากเกินไปและขายมากเกินไปเมื่อเข้าสู่ตลาด

บันทึกสำคัญ:

- นักเทรด Forex มือใหม่ควรระมัดระวังอย่างมากเมื่อทำการตัดสินใจในการเข้าสู่ตลาด ควรหลีกเลี่ยงการเข้าสู่ตลาดก่อนการเปิดเผยรายงานสำคัญทางพื้นฐานเพื่อหลีกเลี่ยงการเผชิญหน้ากับความผันผวนของราคาอย่างรุนแรง หากคุณเลือกที่จะเทรดในช่วงที่มีการประกาศข่าวเสมอควรใช้คำสั่ง stop-loss เพื่อจำกัดความสูญเสียที่อาจเกิดขึ้น การเทรดโดยไม่ใช้คำสั่ง stop-loss อาจทำให้เงินฝากของคุณหายไปอย่างรวดเร็ว โดยเฉพาะถ้าคุณละเลยหลักการการจัดการเงินและเทรดด้วยปริมาณสูง

- จำไว้ว่าการเทรดที่ประสบความสำเร็จต้องใช้แผนการเทรดที่ชัดเจน เหมือนอย่างที่ได้ระบุข้างต้น การทำการตัดสินใจการเทรดโดยไม่พิจารณาจากสถานการณ์ตลาดปัจจุบันนั้นอาจเป็นกลยุทธ์ที่เข้าข่ายความล้มเหลวสำหรับเทรดเดอร์ระหว่างวัน